ROCK HILL, South Carolina - August 5, 2020 - 3D Systems Corporation (NYSE:DDD) announced today its financial results for the second quarter ended June 30, 2020.

Second Quarter Financial and Operational Results

- Reorganizing to focus on two market verticals — Healthcare and Industrial

- Restructuring to reduce operating costs by $100 million per year

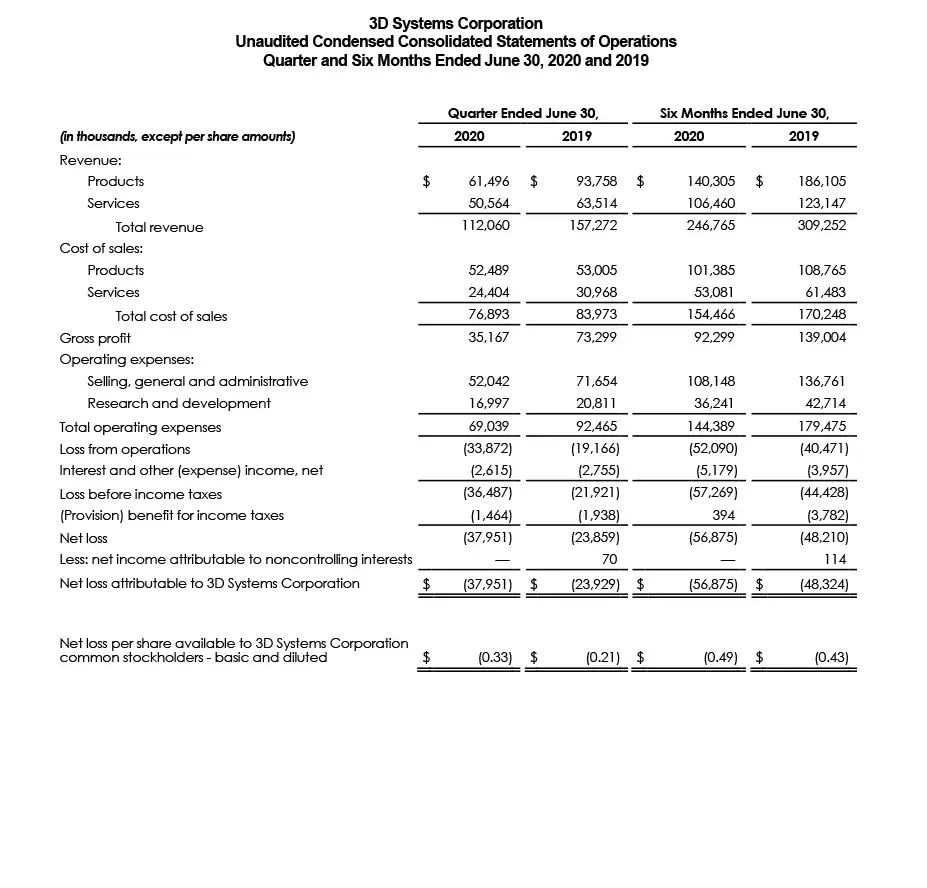

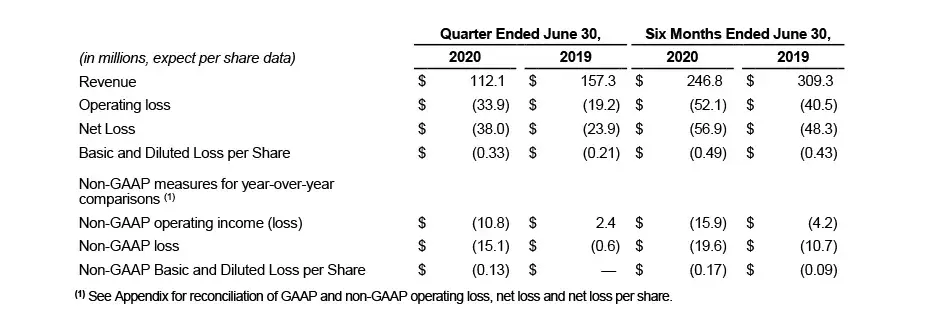

- Q2 2020 GAAP revenue of $112.1 million, compared to $157.3 million in Q2 2019

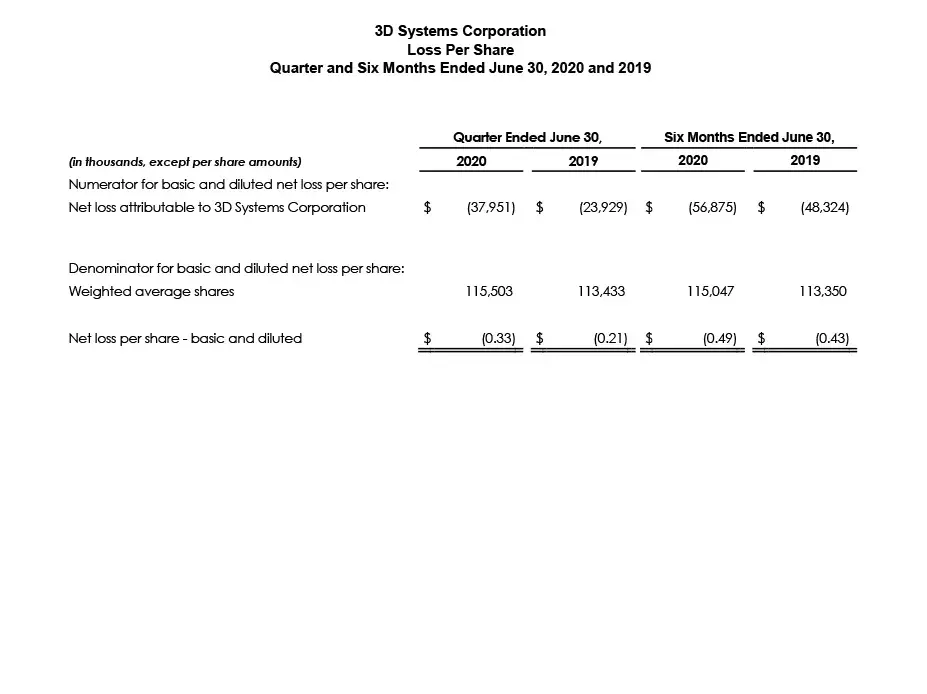

- Q2 2020 GAAP loss of $0.33 per share compared to a loss of $0.21 per share in Q2 2019

- Q2 2020 Non-GAAP loss of $0.13 per share compared to $0.00 per share in Q2 2019

New Strategic Focus and Restructuring: Executive Commentary by Dr. Jeffrey Graves, President and Chief Executive Officer

In a separate press release also issued today, 3D Systems announced a new strategic focus to accelerate the adoption of additive manufacturing solutions.

“We have a tremendous opportunity in this industry, and I am excited by the passion, the breadth of technology and the exceptional capabilities within our company,” said Dr. Graves. “In the two months since I joined 3D Systems, I have held many reviews and discussions with our employees and key customers to understand the value we deliver and the markets that we serve. This has enabled us to state a clear purpose for our company moving forward - one that builds on our unique history and core strengths, which will guide us to an exciting future ahead: We are the leaders in enabling additive manufacturing solutions for applications in growing markets that demand high reliability products.”

Dr. Graves added, “In connection with this organizational realignment we have an opportunity to maximize efficiencies with a need to align our operating costs with current revenue levels. As such, we will reduce our workforce by nearly 20%, with the majority being completed by year-end. This reduction in force is a difficult but essential step in our ongoing strategic process, designed to better position the company for sustainable and profitable growth. I would like to express my appreciation to each of the employees impacted by this decision for their dedicated service."

The company expects the resizing effort, in conjunction with other cost reduction measures, to reduce annualized costs by approximately $100 million by the end of next year. This should enable the company to be profitable at current revenue levels, and be well positioned to leverage the sales growth as it returns. Other cost reduction efforts include reducing the number of facilities and examining every aspect of the company’s manufacturing and operating costs. The company will incur a cash charge in the range of $25 to $30 million for severance, facility closing and other costs, primarily in the second half of this year. The company may incur additional charges in 2021 as it finalizes all the actions to be taken. Non-cash charges related to these actions are expected to be less than $5 million. The company is also evaluating the divestiture of parts of the business that do not align with this strategic focus.

"In response to the COVID-19 pandemic, we have implemented clear protocols across the company and have incorporated measures to further keep our employees safe. Our top priority is to keep our employees, communities and customers safe," continued Dr. Graves.

Second Quarter Results

"Our results in the second quarter reflect continued impact from the COVID-19 pandemic; however, the pandemic has also demonstrated a clear role for flexible supply chain enabled by additive manufacturing, particularly in the medical field, which speaks to our unique capabilities as a provider of hardware, software, materials and services to drive application-specific solutions. 3D Systems was founded on Chuck Hull's focus on application processes, which is the bedrock of our culture. Our technology produces the largest number of production parts by additive manufacturing, with up to half a million parts produced per day. Redirecting the company is intended to bring us back to a sharp application focus on key markets that are growing. With a clear statement of purpose and a return to the ideals we were founded on, I believe 3D Systems will be successful," said Dr. Graves.

Revenue for the second quarter of 2020 decreased 28.7% compared to the same period last year and decreased 16.8% compared to the first quarter of 2020. The lower demand was across all products and services due primarily to the COVID-19 pandemic, as many customers were shutdown or on a significantly reduced level of activity. Revenue from Healthcare decreased 11.4% to $50.0 million, compared to the same period last year, driven by the decrease in the dental market. Industrial sales decreased 38.5% to $62.1 million, compared to the same period last year, as decreases were in all products, materials and services across all geographies.

Gross profit margin in the second quarter of 2020 was 31.4% compared to 46.6% in the same period last year. Non-GAAP gross profit margin was 41.3% compared to 47.4% in the same period last year. During the second quarter of 2020, the company recorded a charge of $10.9 million to costs of sales, primarily attributable to inventory, accessories and inventory commitments for certain product lines that reached their end-of-life. The company has ceased production for these items.

Operating expenses decreased 25.3% to $69.0 million in the second quarter of 2020, compared to the same period a year ago. Selling, general and administrative expenses decreased by 27.4% to $52.0 million and research and development expenses decreased by 18.3% to $17.0 million. Lower operating expenses reflect an employee furlough program in the second quarter, reduced hiring and lower travel expenses as a result of the COVID-19 pandemic as well as savings achieved from cost structuring activities originated in 2019.

On June 30, 2020, the company executed an amendment to its $40 million interest rate swap that reduced the notional amount to $15 million and resulted in a mark-to-market settlement of $1.2 million and a corresponding increase in interest expense for the second quarter of 2020.

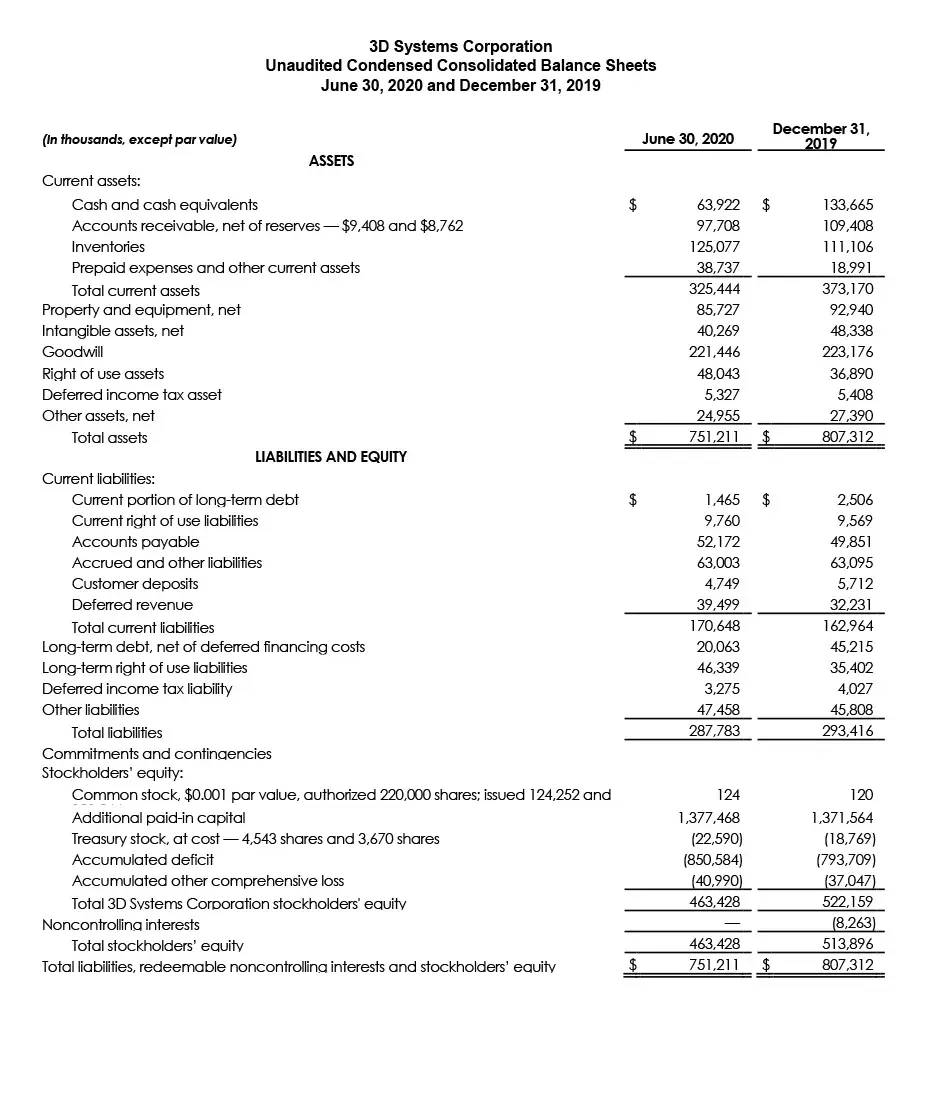

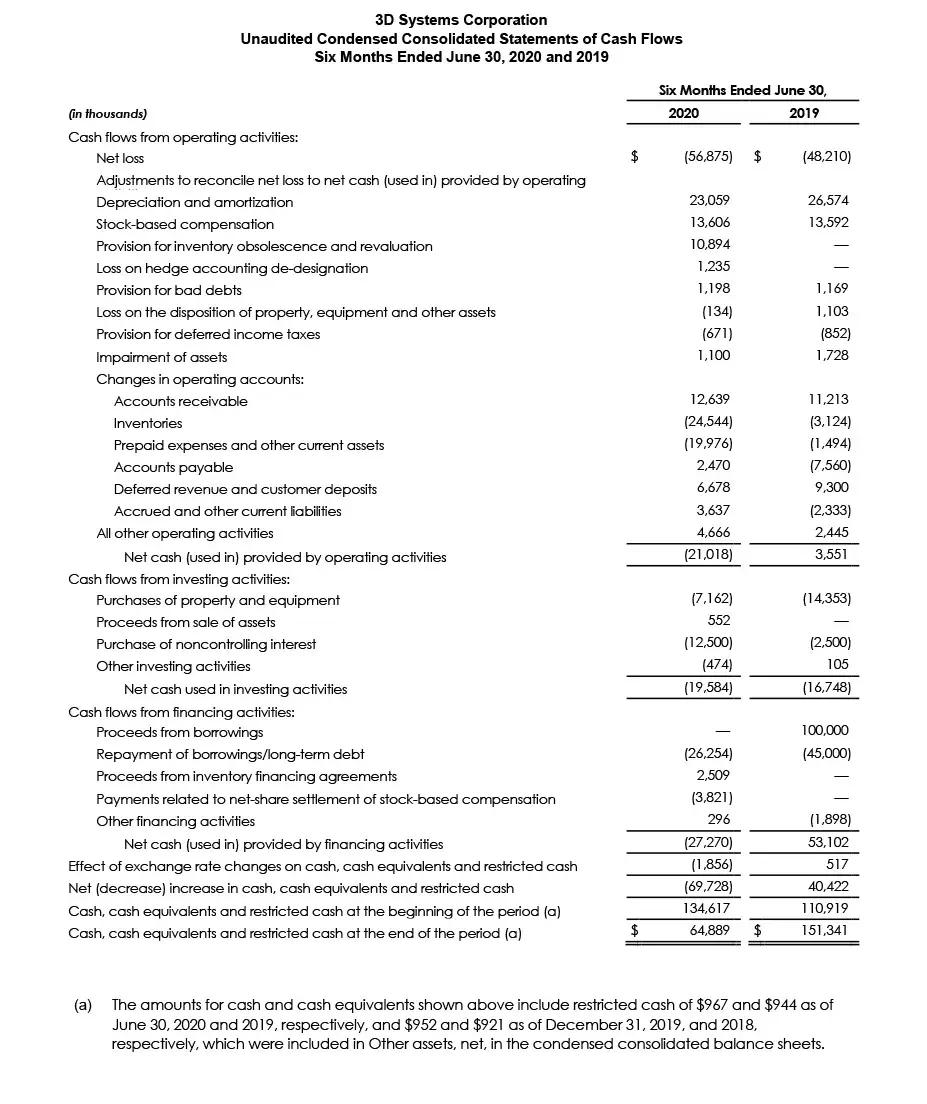

Financial Liquidity

At June 30, 2020, the company had cash on hand of $63.9 million, total debt of $21.5 million and a $100 million unused revolving credit facility with approximately $24 million of availability based on the terms of the agreement. Cash on hand has decreased $69.7 million since December 31, 2019. The uses of cash included $26.3 million for repayments of debt, $21.0 million for operations, $12.5 million for payments to purchase noncontrolling interests and $7.2 million for capital expenditures.

To provide the company with sufficient financial flexibility to complete this reorganization and to work through these uncertain times caused by the pandemic, the Board of Directors approved an at-the-market equity program (“ATM Program”) that allows the company from time to time to issue up to a total of $150 million of shares of the company’s common stock to the public, at the company’s discretion. For more information on the ATM Program, please see the company’s press release on the ATM Program issued earlier today.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of these securities, in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

Q2 2020 Conference Call and Webcast

3D Systems expects to file its Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 with the Securities and Exchange Commission on August 5, 2020. The company will host a conference call and simultaneous webcast to discuss these results today, which may be accessed as follows:

Date: Wednesday, August 5, 2020

Time: 4:30 p.m. Eastern Time

Listen via webcast: www.3dsystems.com/investor

Participate via telephone: 201-689-8345

A replay of the webcast will be available approximately two hours after the live presentation at www.3dsystems.com/investor.

Forward-Looking Statements

Certain statements made in this release that are not statements of historical or current facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. In many cases, forward looking statements can be identified by terms such as “believes,” “belief,” “expects,” “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative of these terms or other comparable terminology. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations and may include comments as to the company’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors described under the headings “Forward-Looking Statements” and “Risk Factors” in the company’s periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. Although management believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at which such performance or results will be achieved. The forward-looking statements included are made only as the date of the statement. 3D Systems undertakes no obligation to update or review any forward-looking statements made by management or on its behalf, whether as a result of future developments, subsequent events or circumstances or otherwise.

Presentation of Information in this Press Release

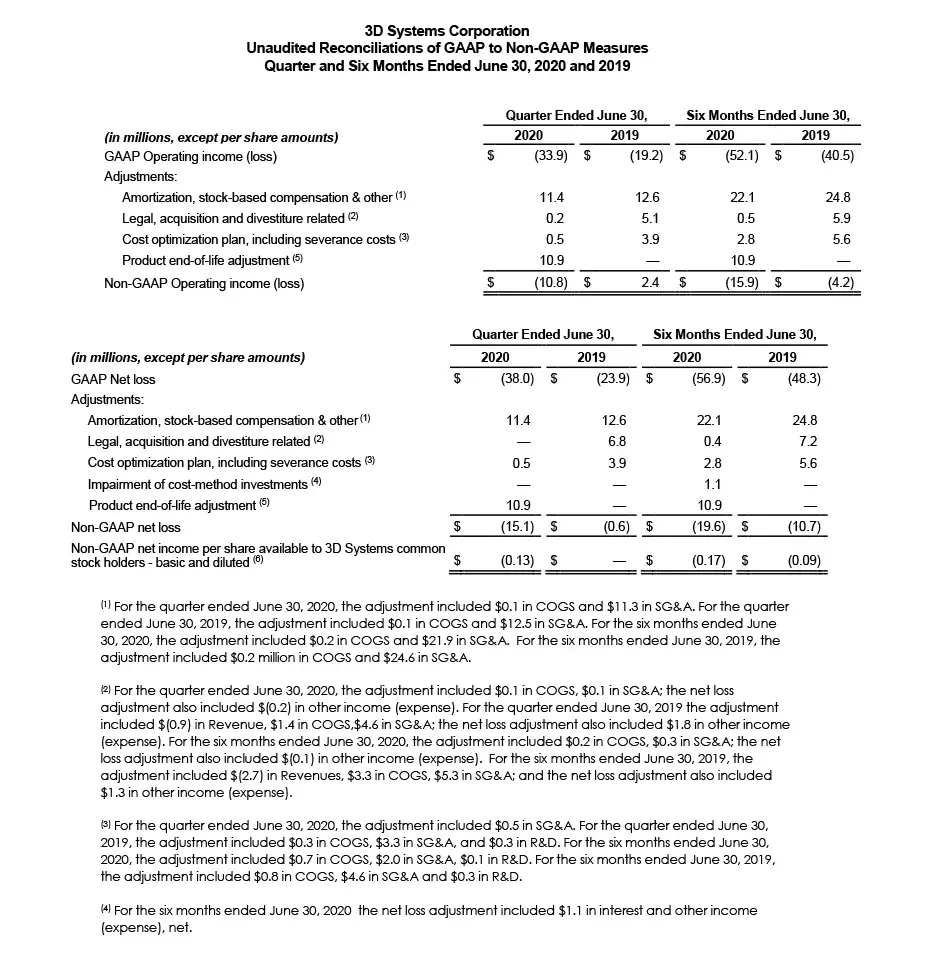

To facilitate a better understanding of the impact that strategic acquisitions, non-recurring charges and certain non-cash expenses had on its financial results, the company reported non-GAAP measures excluding the impact of amortization of intangibles, acquisition and severance expenses, stock-based compensation expense, litigation settlements and charges related to strategic decisions and portfolio realignment. A reconciliation of GAAP to non-GAAP results is provided in the accompanying schedule.

About 3D Systems

More than 30 years ago, 3D Systems brought the innovation of 3D printing to the manufacturing industry. Today, as the leading Additive Manufacturing solutions partner, we bring innovation, performance, and reliability to every interaction - empowering our customers to create products and business models never before possible. Thanks to our unique offering of hardware, software, materials and services, each application-specific solution is powered by the expertise of our application engineers who collaborate with customers to transform how they deliver their products and services. 3D Systems’ solutions address a variety of advanced applications in Healthcare and Industrial markets such as Medical and Dental, Aerospace & Defense, Automotive and Durable Goods. More information on the company is available at www.3dsystems.com

Tables Follow