Third Quarter Financial and Operational Results

- Revenue of $156.1 million reflects double-digit growth versus third quarter 2020

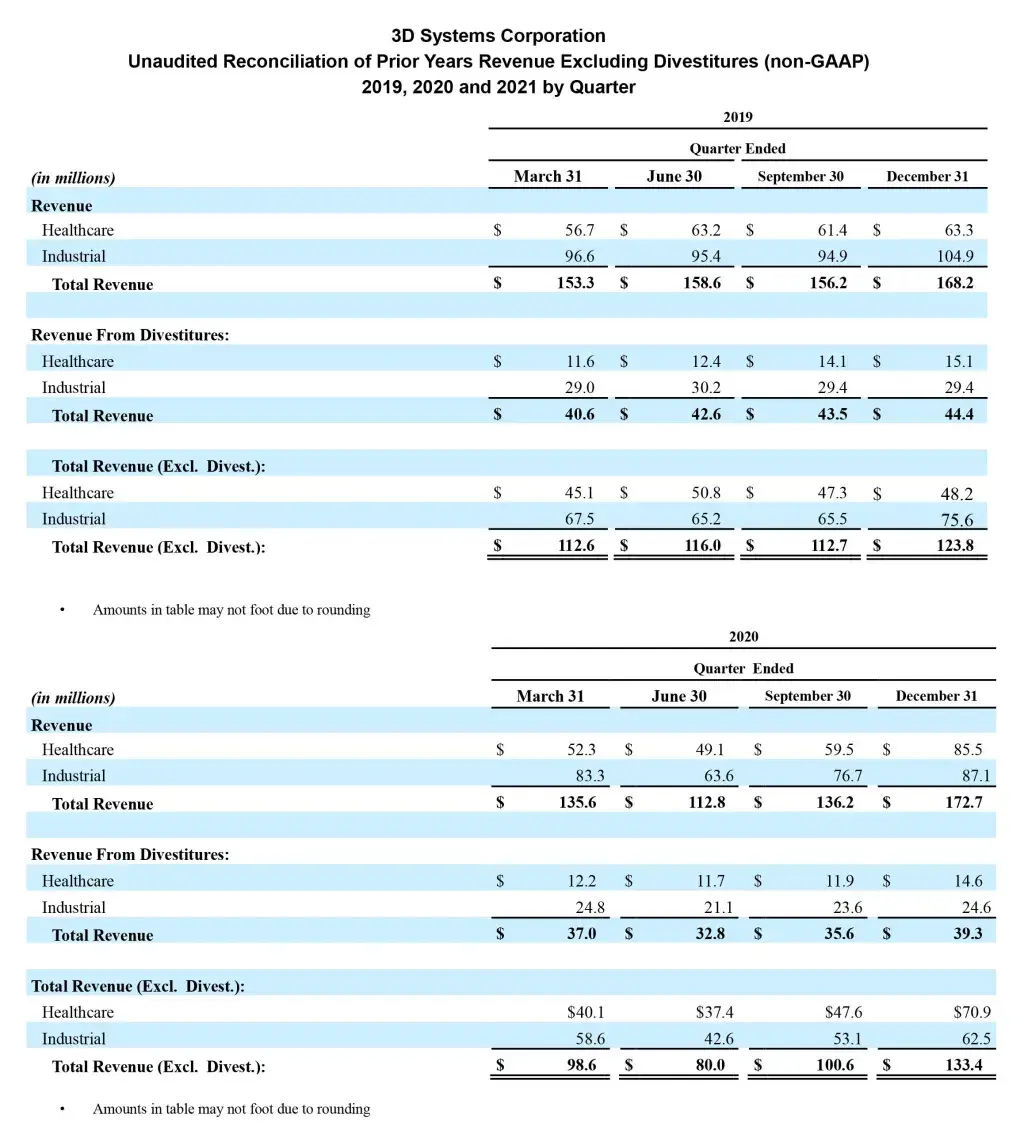

- Revenue adjusted for divestitures(1) was 35.9% higher and 21.2% higher than third quarter 2020 and pre-pandemic third quarter 2019, respectively – reflecting the continued strong growth momentum of the business

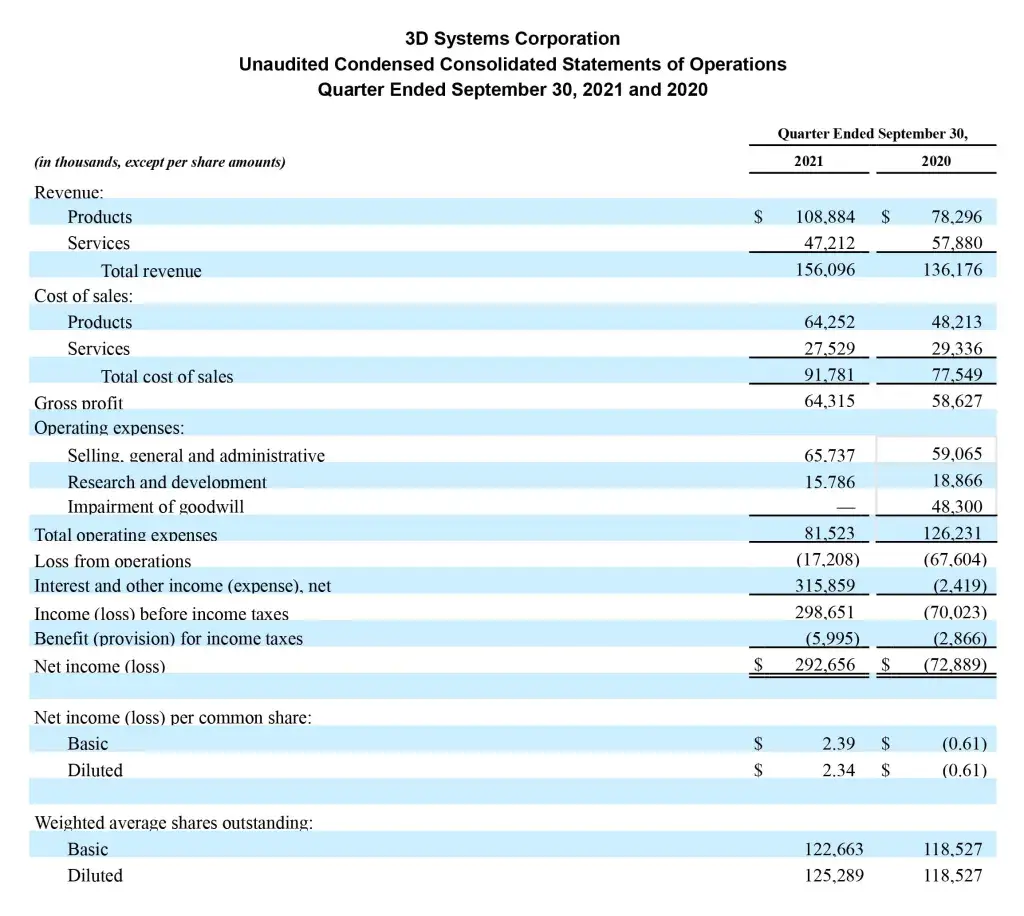

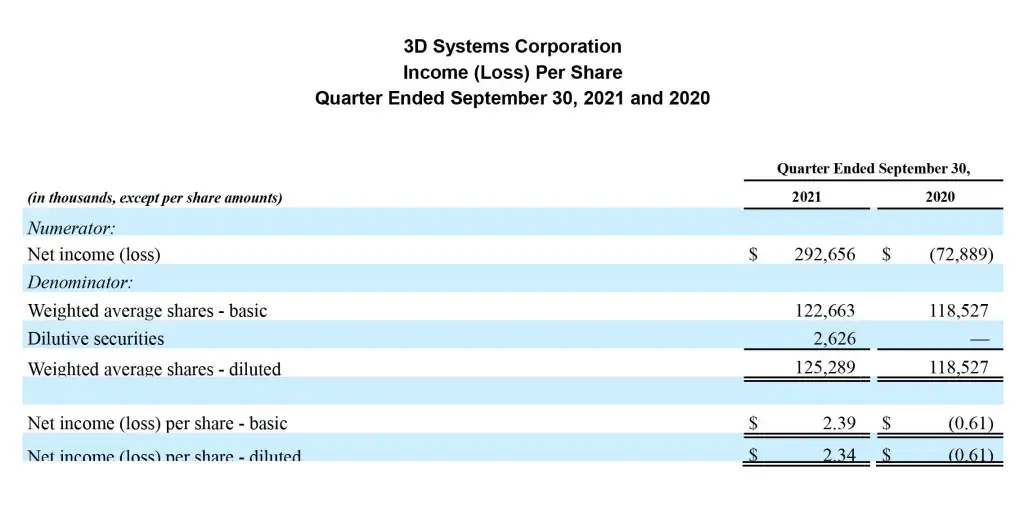

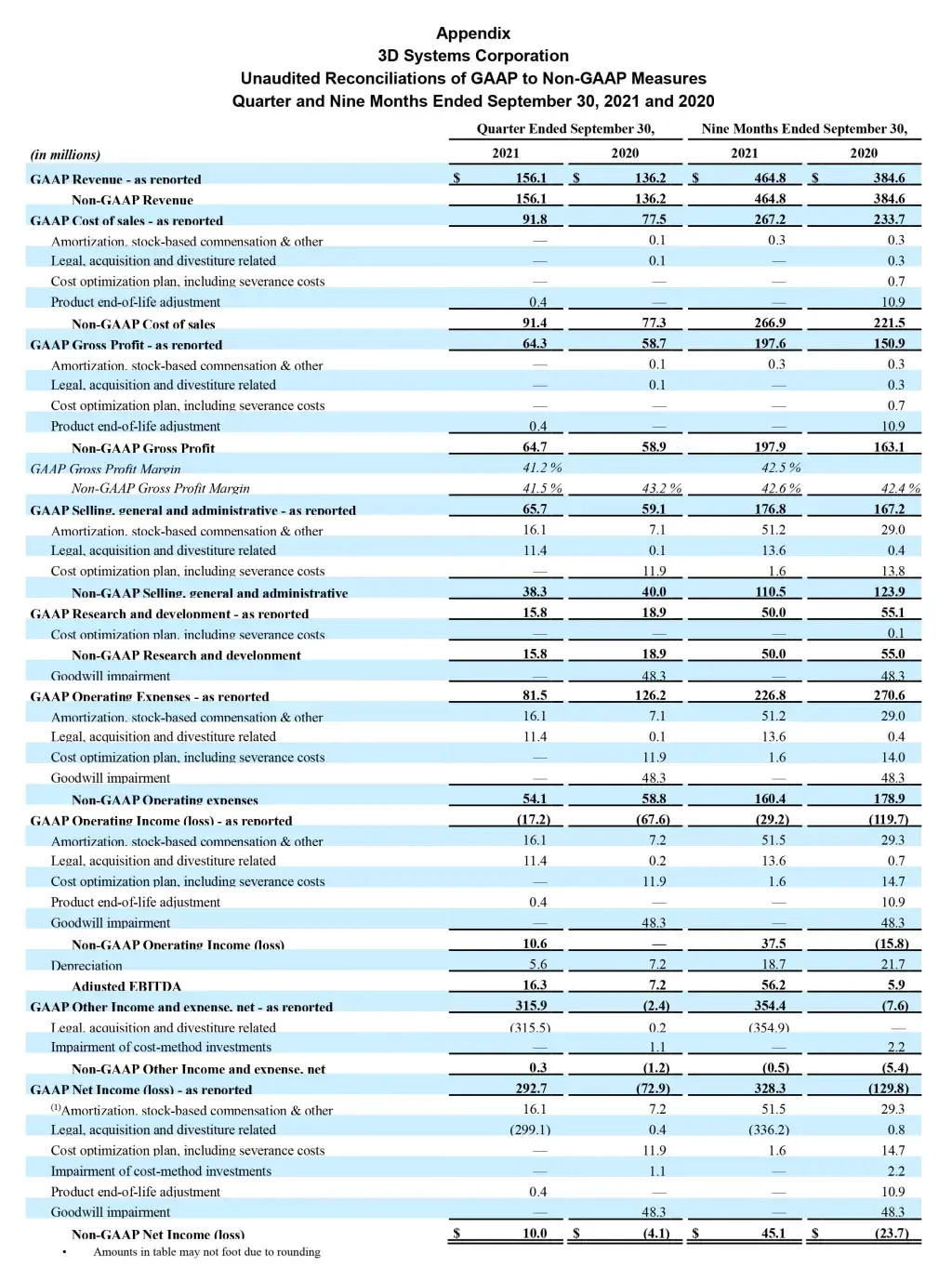

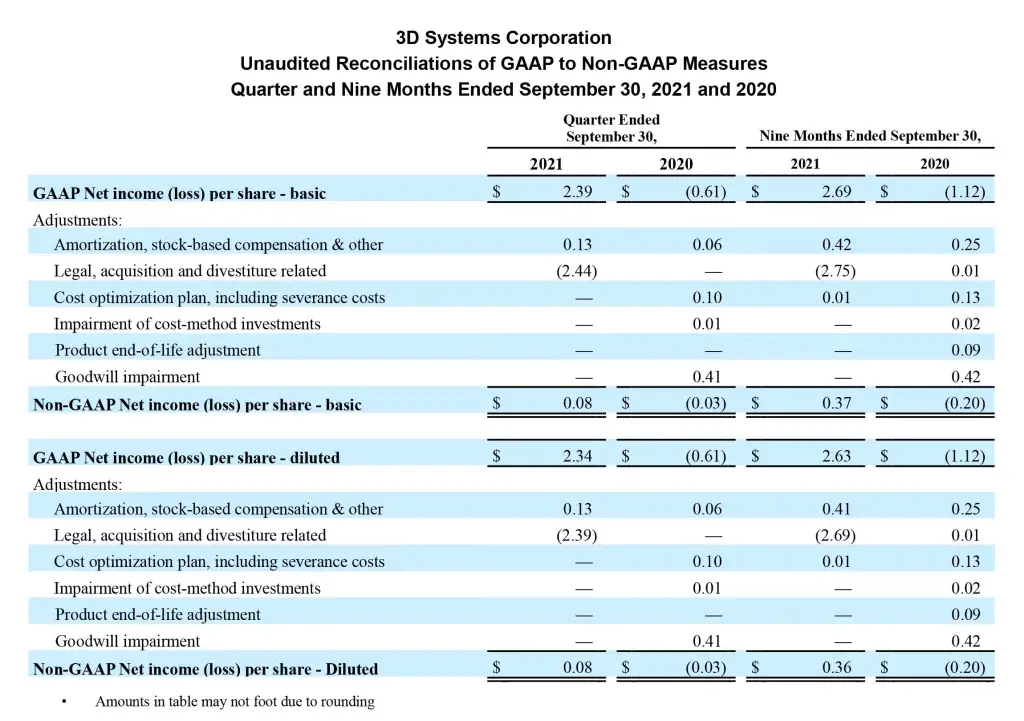

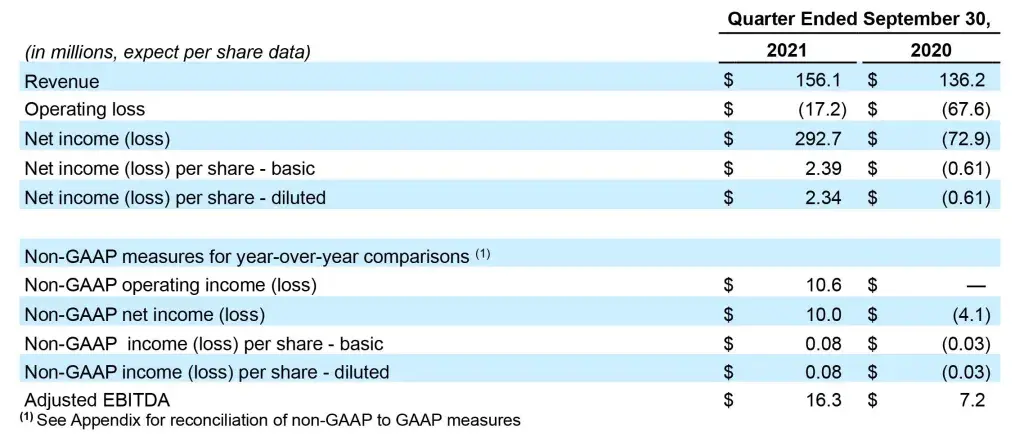

- Increasing revenue and sustained cost management drove strong profitability, with adjusted EBITDA margin of 10.5%; diluted GAAP earnings per share of $2.34, which includes gains from divestitures, and diluted Non-GAAP earnings per share of $0.08(1)

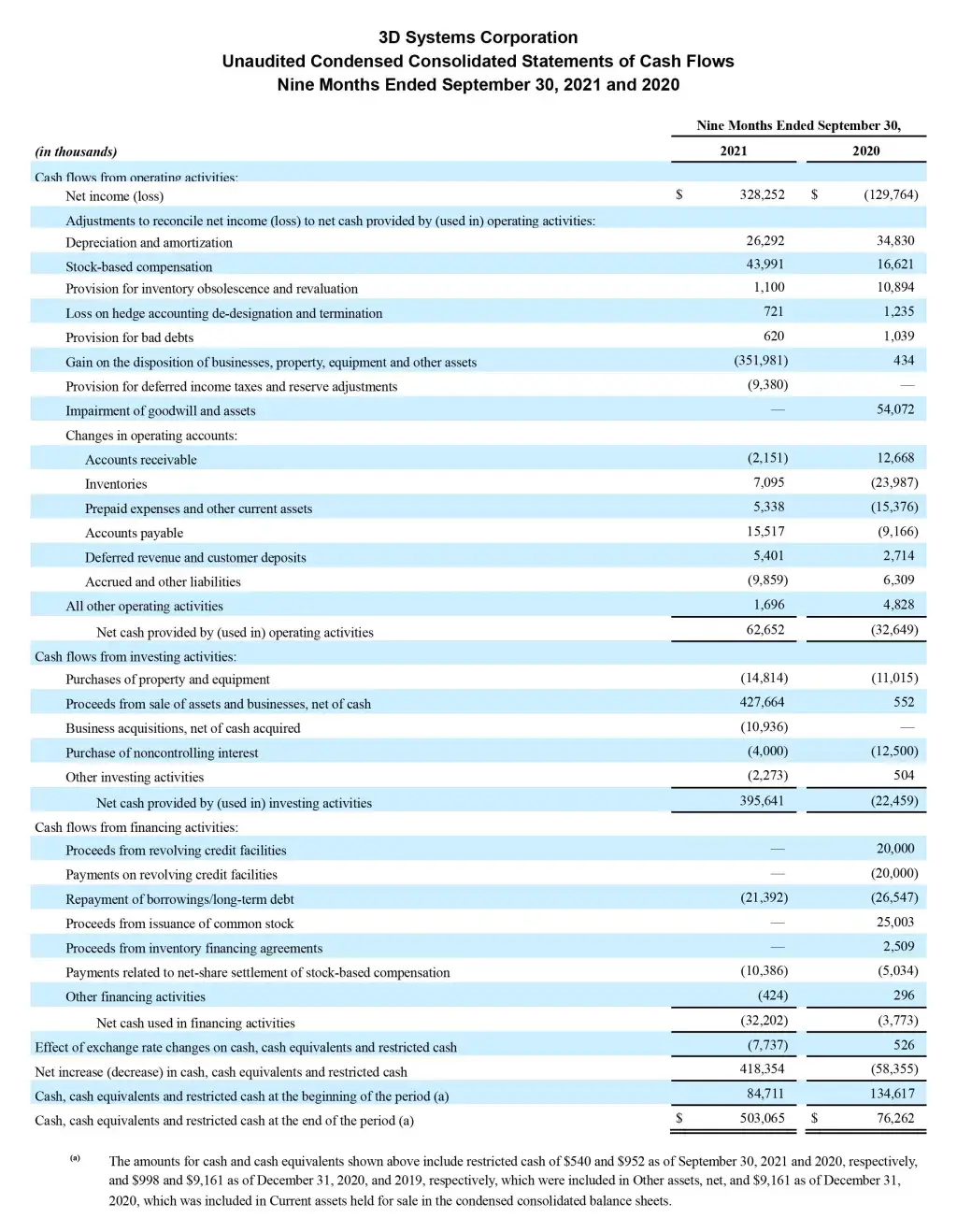

- Financial performance yielded positive operating cash flow of $20.7 million, the fourth consecutive quarter of positive cash flow from operations

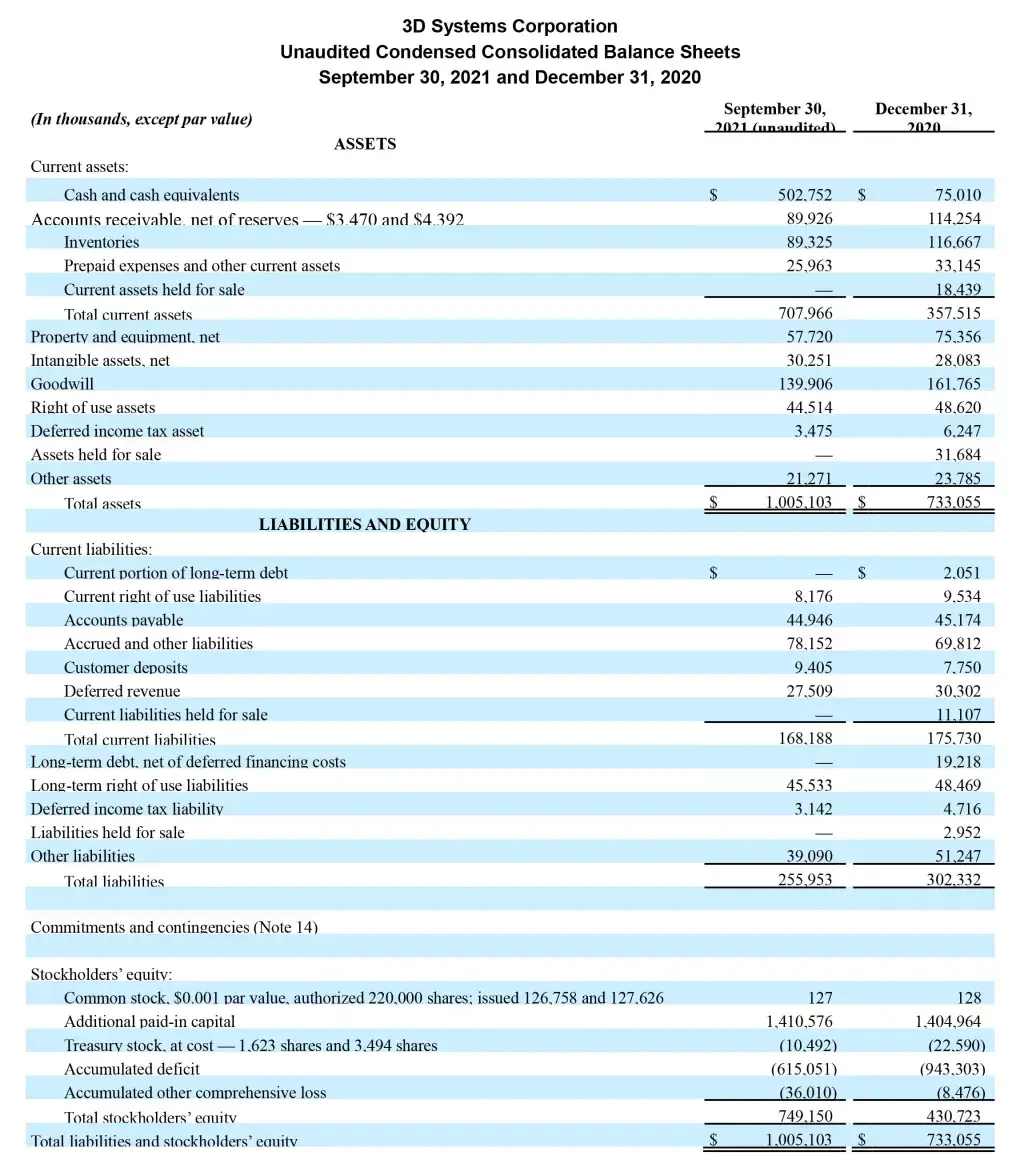

- Closed on previously announced divestitures, increasing cash on the balance sheet to $502.8 million with no debt

- Two recently announced acquisitions, Oqton, closed on November 1, and Volumetric Biotechnologies, anticipated to close in the fourth quarter 2021, are expected to position the company for continued high-margin growth

Summary Comments on Results

Commenting on the results, President and Chief Executive Officer, Dr. Jeffrey Graves said, “In the third quarter last year we experienced the beginnings of a recovery from the depths of the COVID-19 pandemic. Businesses were opening up, and customers were returning. A year later, global economies are much stronger. We still see continued challenges with COVID-19, and new challenges around supply chains, but thanks to the great work by our team here at 3D Systems, we are pleased to report another strong quarter of double-digit growth as compared to the same period in both 2020 and pre-pandemic 2019, adjusted for divestitures. While we were delivering these results through our core portfolio of business, we also completed our divestitures of non-core assets and began the transition to a strategic growth phase. Our focus during this phase is investing in significant opportunities that we believe will drive high-margin recurring revenue, as evidenced by our acquisition in the software space of Oqton, and the hiring of a new Chief Scientist to further advance our technology development. More recently we made two announcements in the exciting area of regenerative medicine: the acquisition of Volumetric Biotechnologies and the expansion of our development agreement with United Therapeutics to include two additional human organs. The acquisition brings unique biological talent to our organization, including a new Chief Scientist for Regenerative Medicine, that we believe will allow us to expand and accelerate our growth in human and laboratory applications for bioprinting. These investments in software, products platforms, and regenerative medicine compliment an existing business portfolio that generated $20.7 million in cash from operations during the third quarter to bolster a balance sheet that boasted $503 million of cash, ready to support additional growth.”

Dr. Graves summarized, “I couldn’t be more pleased with our performance this quarter, both organic and inorganic. We will continue to focus investment in areas that we believe solve customers’ complex needs, drive adoption of additive manufacturing, and generate high margin, recurring revenue streams.”

Summary of Third Quarter Results

Revenue for the third quarter of 2021 increased 14.6% to $156.1 million compared to the same period last year and increased 35.9% when excluding businesses divested in 2020 and 2021. The results reflect ongoing strength in Industrial, which had revenue growth of 4.0% to $79.7 million compared to the same period last year. Adjusted for divestitures, Industrial revenue increased 28.1% year-over-year.

Revenue from Healthcare increased 28.3% to $76.4 million, compared to the same period last year. Adjusted for divestitures, Healthcare revenue increased 44.5% year-over-year, as we saw high demand for dental applications, both printers and materials.

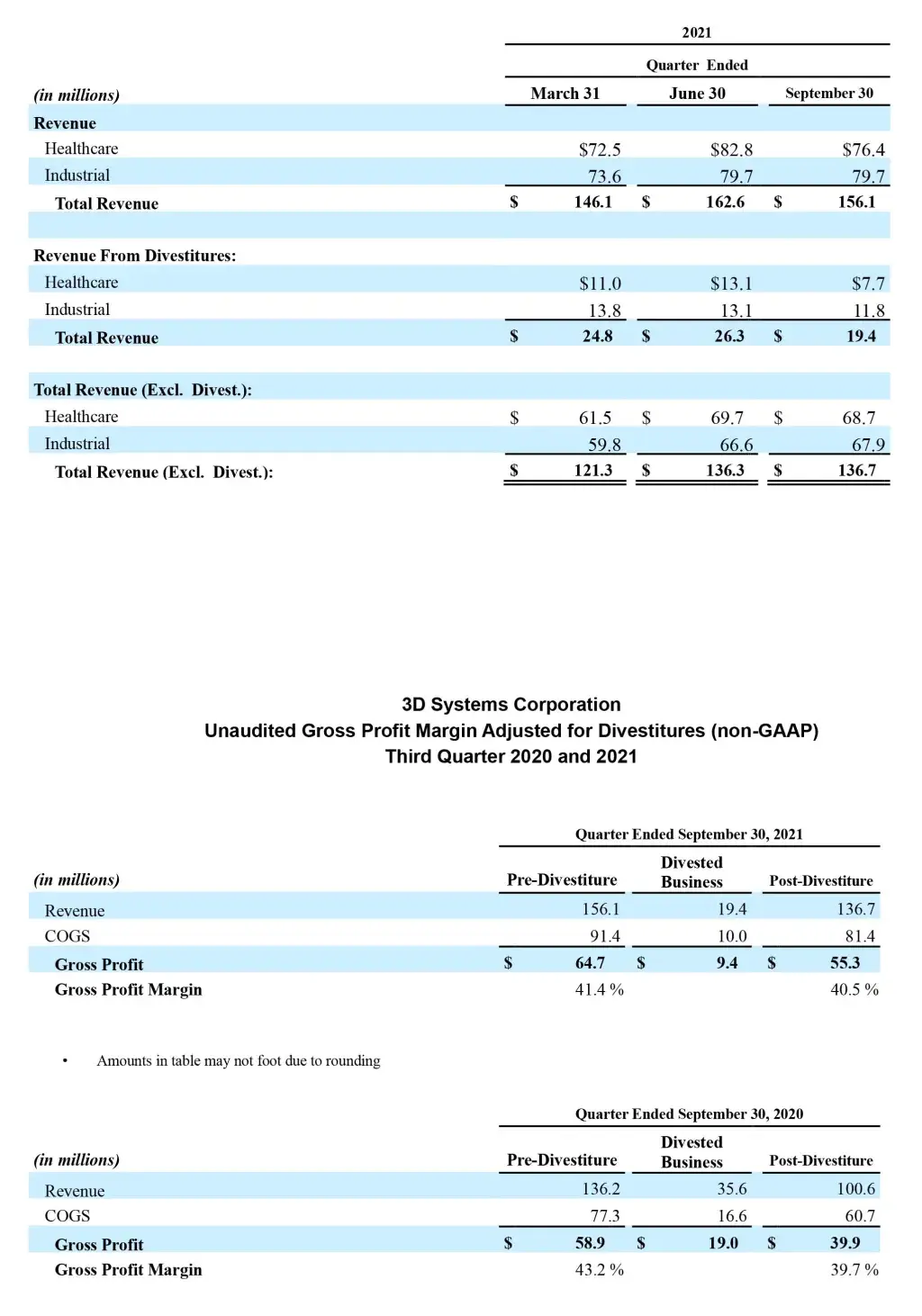

Gross profit margin in the third quarter of 2021 was 41.2% compared to 43.1% in the same period last year. Non-GAAP gross profit margin was 41.5% compared to 43.2% in the same period last year. Gross profit margin decreased primarily as a result of businesses divested in 2020 and 2021. Excluding the impact of divestitures, gross profit margin increased 80 basis points in the third quarter of 2021 compared to the same period last year.

Operating expenses decreased 35.4% to $81.5 million in the third quarter of 2021, compared to the same period a year ago, primarily as a result of an impairment to goodwill recorded in the third quarter 2020. On a non-GAAP basis, operating expenses were $54.1 million, an 8.0% decrease from the third quarter of the prior year. The lower non-GAAP operating expenses reflect savings achieved from cost restructuring activities and divestitures, partly offset by spending in targeted areas to support future growth.

2021 Gross Profit Margin Outlook

Updating prior guidance, on a non-GAAP basis the company expects 2021 gross profit margins to be between 41% and 43%.

Financial Liquidity

At September 30, 2021, the company had cash on hand of $502.8 million and no debt. Cash has increased $418.4 million since December 31, 2020, driven primarily by net proceeds from divestitures of $427.3 million and cash generated from operations of $62.7 million, partially offset by capital expenditures and repayment of debt.

Q3 2021 Conference Call and Webcast

3D Systems expects to file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 with the Securities and Exchange Commission today, November 8, 2021. The company will host a conference call and simultaneous webcast to discuss these results tomorrow morning, which may be accessed as follows:

Date: Tuesday, November 9, 2021

Time: 8:30 a.m. Eastern Time

Listen via webcast: www.3dsystems.com/investor

Participate via telephone: 201-689-8345

A replay of the webcast will be available approximately two hours after the live presentation at www.3dsystems.com/investor.

Forward-Looking Statements

Certain statements made in this release that are not statements of historical or current facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. In many cases, forward looking statements can be identified by terms such as “believes,” “belief,” “expects,” “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative of these terms or other comparable terminology. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations and may include comments as to the company’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors described under the headings “Forward-Looking Statements” and “Risk Factors” in the company’s periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. Although management believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at which such performance or results will be achieved. The forward-looking statements included are made only as the date of the statement. 3D Systems undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf, whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law.

Presentation of Information in this Press Release

3D Systems reports is financial results in accordance with GAAP. To facilitate a better understanding of the impact that strategic acquisitions, non-recurring charges and certain non-cash expenses had on its financial results, management reviews certain non-GAAP measures, including non-GAAP revenue, non-GAAP revenue adjusted for divestitures, non-GAAP Cost of Sales, non-GAAP Operating Income, non-GAAP Net Income (Loss), non-GAAP Basic and Diluted Income (Loss) per Share, non-GAAP Gross Profit, non-GAAP Gross Profit Margin, non-GAAP Gross Profit Margin adjusted for divestitures, non-GAAP SG&A Expenses, non-GAAP R&D, non-GAAP Other Income and Expense and non-GAAP Operating Expenses, each of which exclude the impact of amortization of intangibles, acquisition and severance expenses, stock-based compensation expense, litigation settlements and charges related to strategic decisions and portfolio realignment, and Adjusted EBITDA, defined as non-GAAP Operating Income plus depreciation, and Adjusted EBITDA Margin, defined as Adjusted EBITDA divided by revenue, to better evaluate period-over-period performance. A reconciliation of GAAP to non-GAAP results is provided in the accompanying schedule.

3D Systems does not provide forward-looking guidance on a GAAP basis. The company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measures without unreasonable effort because 3D Systems cannot reliably forecast legal, acquisition and divestiture expenses, restructuring expenses, product end of life adjustments and goodwill impairment, which are difficult to predict and estimate. These items are inherently uncertain and depend on various factors, many of which are beyond the company’s control, and as such, any associated estimate and its impact on GAAP performance could vary materially.

About 3D Systems

More than 30 years ago, 3D Systems brought the innovation of 3D printing to the manufacturing industry. Today, as the leading Additive Manufacturing solutions partner, we bring innovation, performance, and reliability to every interaction - empowering our customers to create products and business models never before possible. Thanks to our unique offering of hardware, software, materials and services, each application-specific solution is powered by the expertise of our application engineers who collaborate with customers to transform how they deliver their products and services. 3D Systems’ solutions address a variety of advanced applications in Healthcare and Industrial markets such as Medical and Dental, Aerospace & Defense, Automotive and Durable Goods. More information on the company is available at www.3dsystems.com

Tables Follow