ROCK HILL, South Carolina - February 28, 2023 - 3D Systems Corporation (NYSE:DDD) announced today its financial results for the fourth quarter and full year ended December 31, 2022.

Fourth Quarter Financial Results and Recent Business Highlights

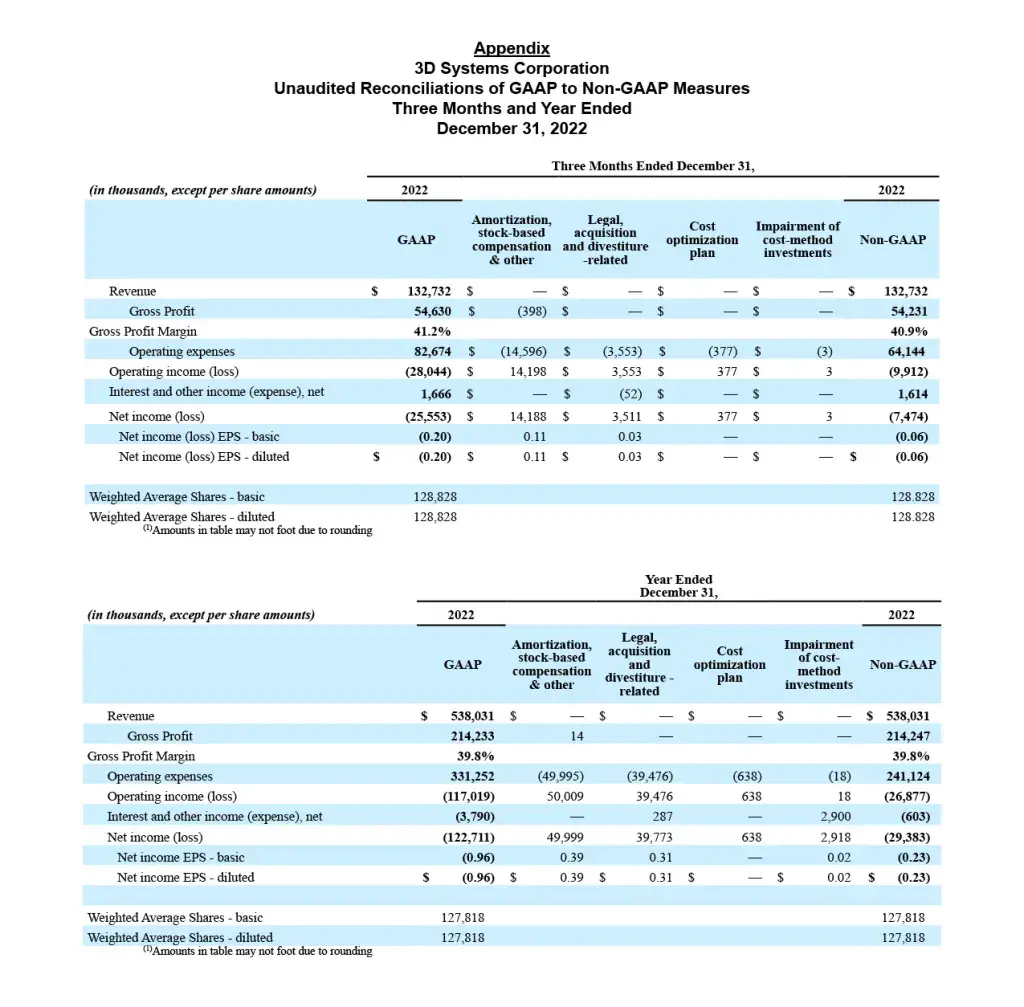

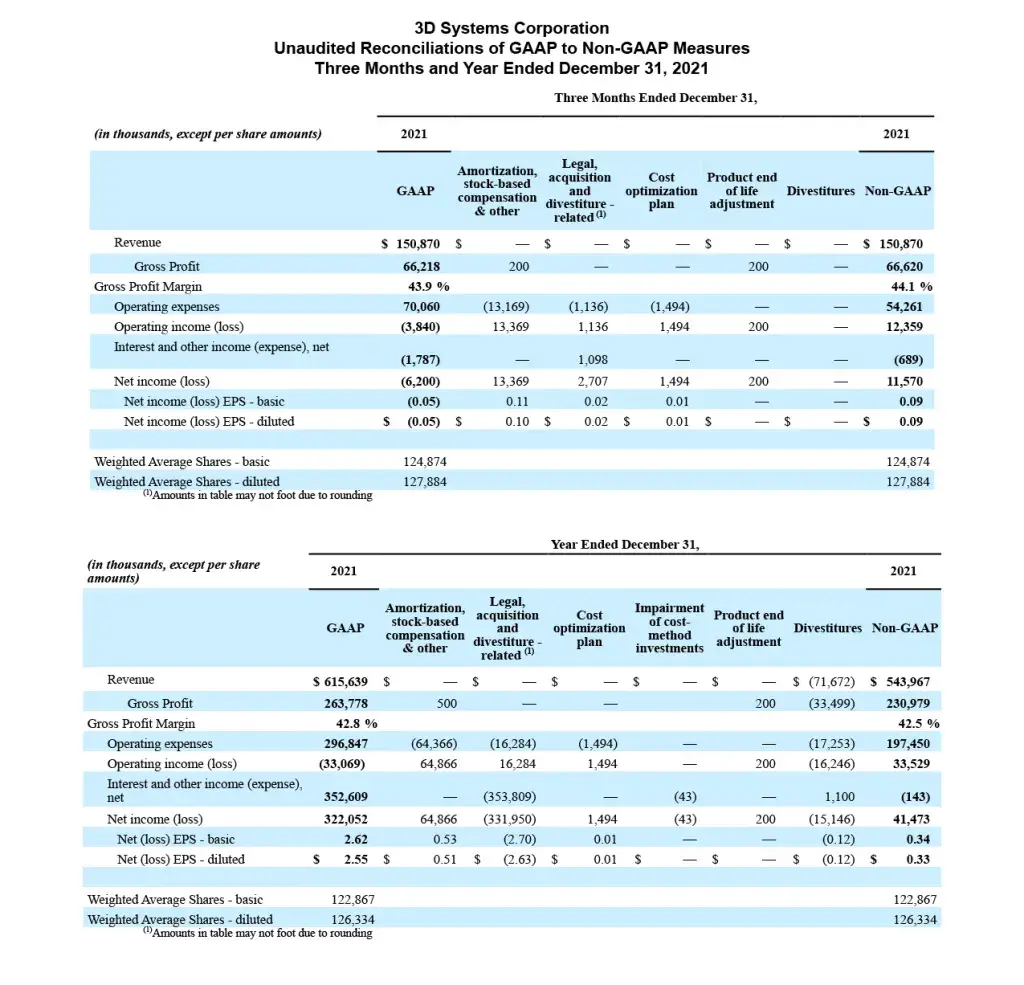

(All numbers are unaudited and are presented in thousands, except per share amounts or otherwise noted)

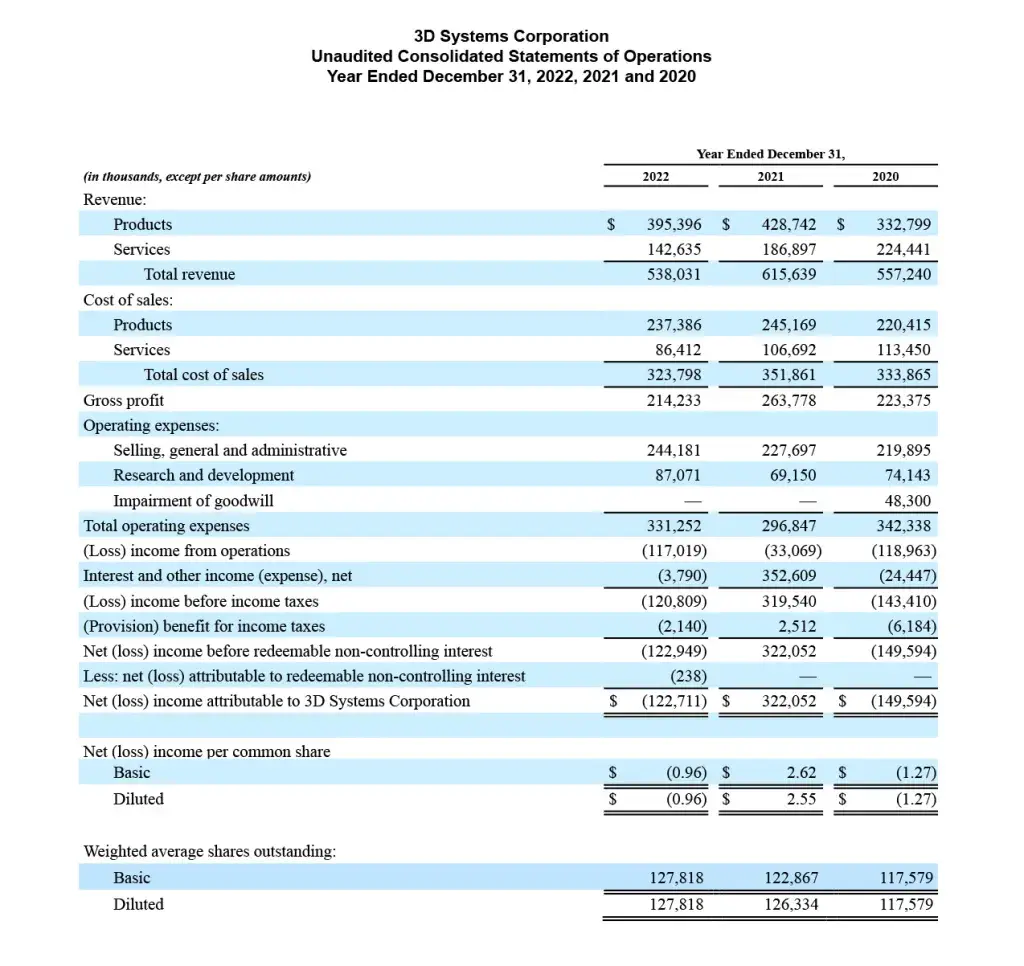

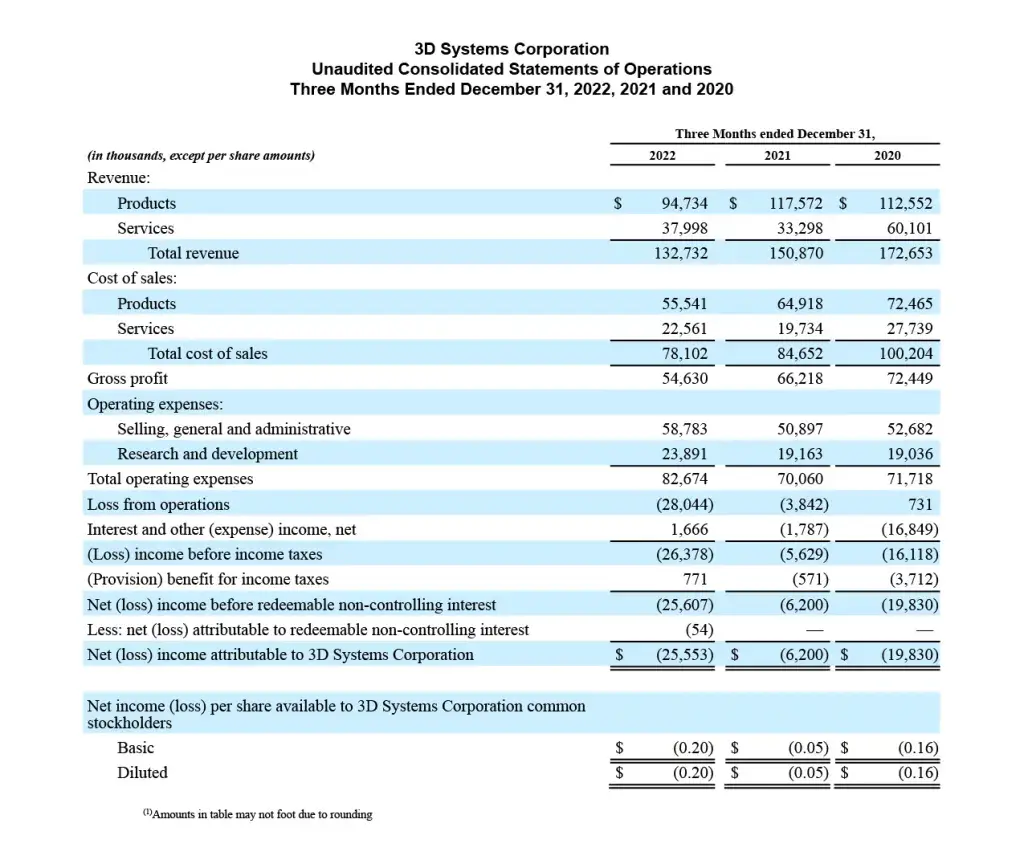

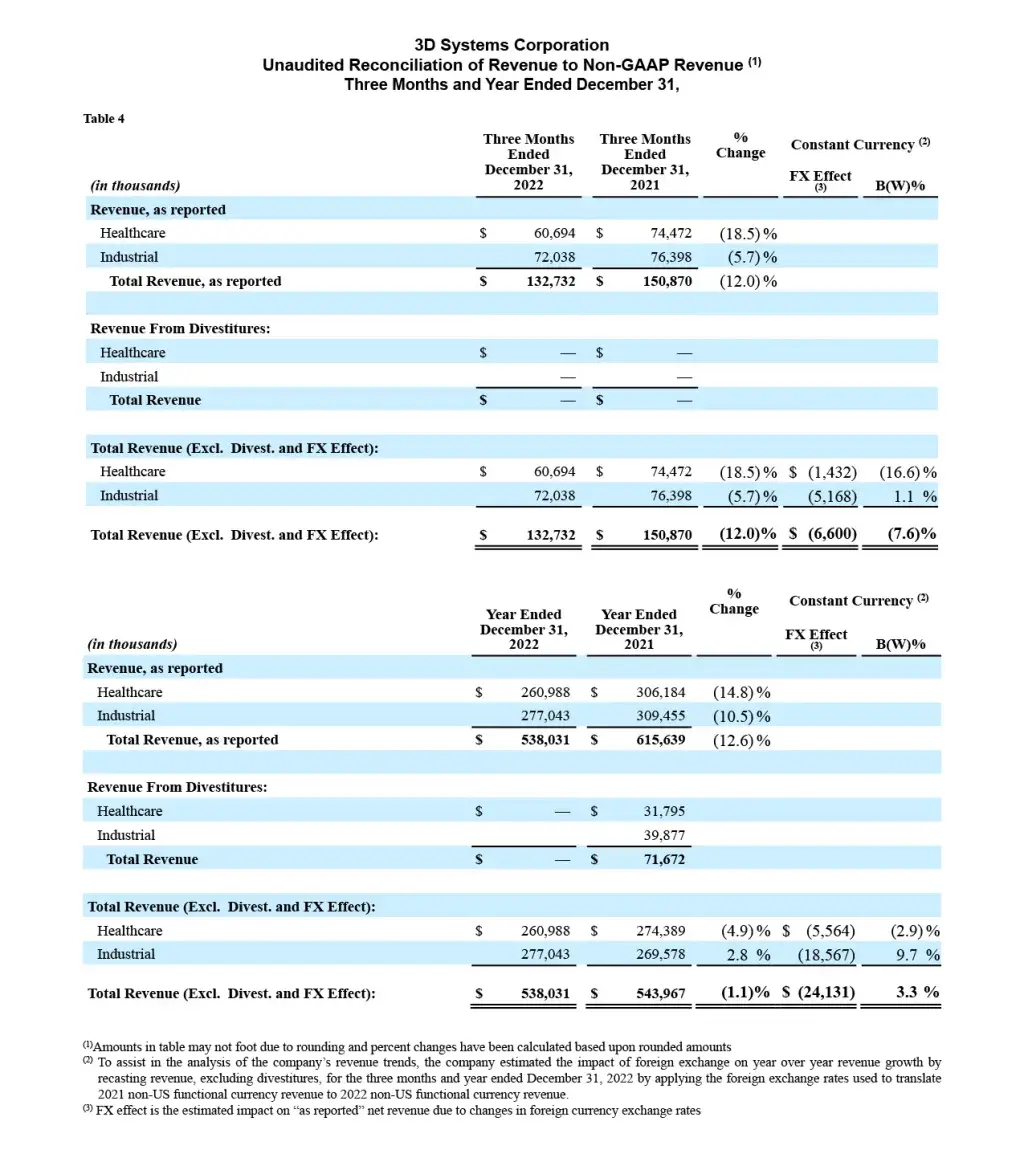

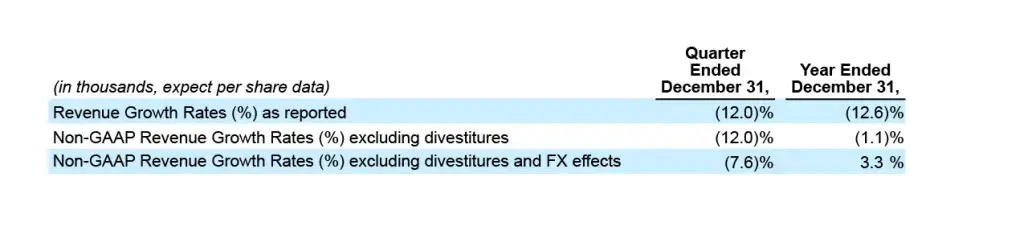

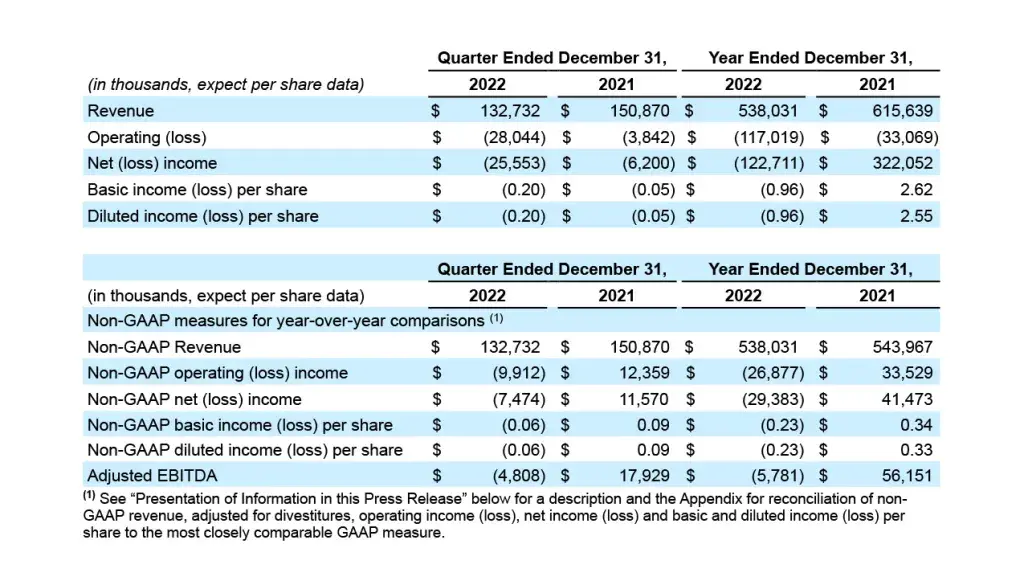

- Q4 2022 revenue of $132,732 decreased 12.0% compared to Q4 2021; Non-GAAP Q4 2022 revenue on a constant currency basis(1) decreased 7.6%, reflecting weakness in the dental orthodontics market

- Net loss of $25,553, diluted loss per share of $0.20, and diluted non-GAAP loss per share of $0.06 (1)

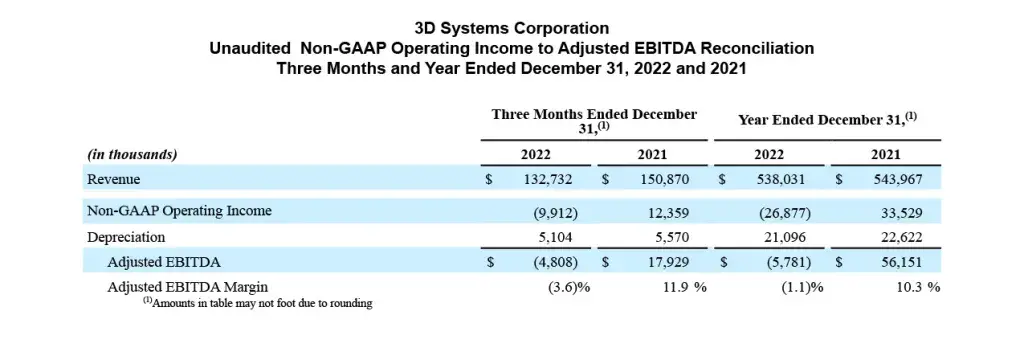

- Negative adjusted EBITDA(1) of $4,808 reflects inflationary impacts on our input costs, unfavorable product mix, and continued investments in growth areas of our business and product portfolio

Full Year 2022 Financial Highlights

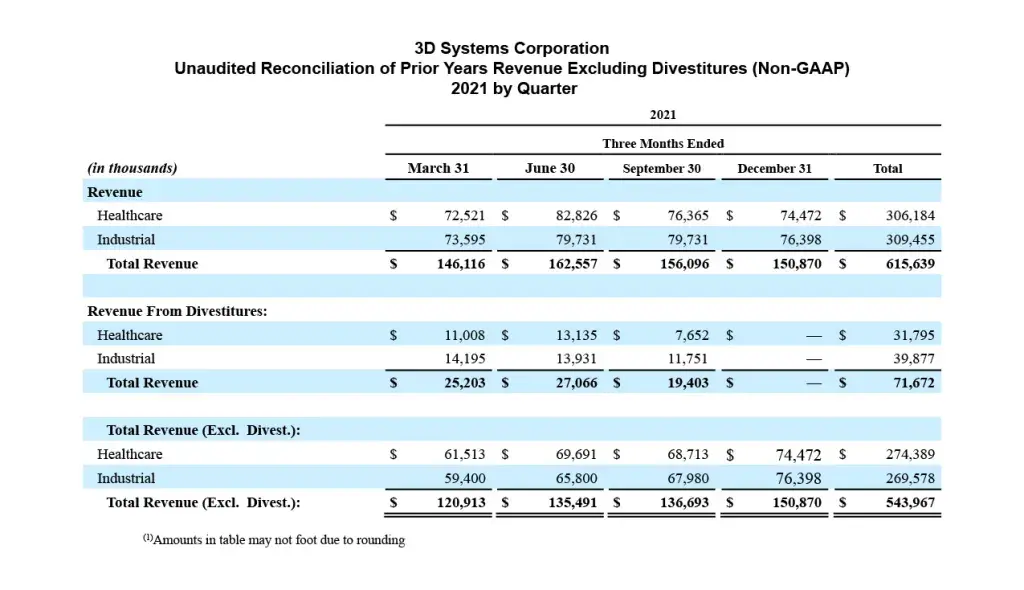

- 2022 revenue of $538,031 decreased 12.6% compared to 2021 revenue of $615,639; Non-GAAP revenue adjusted for divestitures and on a constant currency(1) basis increased 3.3%, reflecting solid demand in both the Industrial and Healthcare segments despite macroeconomic challenges, offset by lower sales to certain dental market customers

- Net loss of $122,711, diluted loss per share of $0.96, and diluted non-GAAP loss per share of $0.23(1)

- Negative adjusted EBITDA(1) of $5,781 reflects inflationary impacts on our input costs and continued investments in growth areas of our business and product portfolio

- Cash and short-term investments of $568,737 position the company for continued growth investments

2023 Outlook

- Continued softness in dental orthodontic market fully offset by strong performance in Industrial and non-dental Healthcare Solutions markets leading to mid-single digit revenue growth

- Positive full year Adjusted EBITDA and free cash flow support an already-strong balance sheet

- Sustained investments in core technologies and emerging regenerative medicine markets

Summary Comments on Results

Commenting on 2022 results and the outlook for 2023, Dr. Jeffrey Graves, President and CEO of 3D Systems said, "2022 was a year of strong investment in our development of next generation hardware, materials, and software platforms despite facing significant macroeconomic and geopolitical headwinds as well as softness in our key dental orthodontic market attributable to inflationary pressure on consumer discretionary spending. By sustaining this investment focus, we made major progress on the refresh of our printer portfolio, as evidenced in part by recent new product announcements. More such announcements will follow throughout 2023 as we complete the refresh of virtually our entire product portfolio. This organic development was complemented by our acquisition of three early-stage technology platforms over the last 18 months, which further broadened the range of customer applications we can now address. Continuity in these initiatives was essential given the continued momentum we are seeing in the adoption of additive manufacturing in production environments across both our Healthcare and Industrial Solutions markets. Sustaining these investments in the face of 2022's many headwinds required us to target our investment spending carefully, control operating costs, and leverage our strong balance sheet. This focus, combined with our improved operational execution gained through selective in-sourcing of manufacturing, has reinforced our industry-leading breadth of additive manufacturing technologies, our unparalleled applications expertise, and scale needed to meet our expanding customer needs for years to come."

"For 2023, given the continued inflationary environment and the pressure it inevitably puts on consumer discretionary spending, our revenue guidance assumes continued softness in the dental orthodontic market. On a positive note, we expect this softness in dental to be more than offset by the strong growth we currently anticipate in virtually all other key markets across our Healthcare and Industrial Solutions segments. This strength is being driven by a rapid expansion of new production applications and the accelerating efforts by our global customers to restructure their supply chains and reduce enterprise risk. The net result of these effects is an expected consolidated 2023 revenue growth rate in the mid-single digits, with mid-teens growth across all our non-dental markets."

"In 2023 we will place a high priority on profitability and cash performance as we increasingly harvest the gains in efficiency that our operations in-sourcing has provided. This focus will enable us to offset headwinds in our dental orthodontic market and to support our increasing investment in Systemic Bio and other regenerative medicine initiatives. From these investments, we expect to make meaningful announcements in these areas over the next 12 to 24 months as we move through pre-clinical trials for our biological applications and customer acceptance tests in the pharmaceutical markets. To further our gains in operating efficiency, this morning we announced a multi-pronged restructuring initiative designed to realize additional cost synergies in multiple parts of our business. We will complete these actions in the first half of this year. Based on our projected growth profile, combined with the cost actions completed last year and in early 2023, we expect to generate positive Adjusted EBITDA and positive free cash flow for full year 2023, excluding one-time restructuring costs."

"By executing on our strategic plan, we have positioned our Healthcare and Industrial Solutions segments for strong financial performance against the backdrop of an additive manufacturing industry that is poised for rapid future growth. In addition to this exciting trajectory for our current core business, we increasingly understand the remarkable potential of our long-term partnership with United Therapeutics to manufacture human organs for transplantation, and the growth benefits we expect from Systemic Bio, our early-stage business whose unique 3D printed organ-on-a-chip technology has the potential to revolutionize drug development in the pharmaceutical industry."

Dr. Graves concluded, "In designing our budget for 2023, we believe our investment strategy represents the best balance between short term profitability and sustained revenue growth in the current economic and geopolitical environment that we are experiencing. By delivering positive Adjusted EBITDA and free cash generation this year, which will further enhance our already strong balance sheet, while making the most critical investments in R&D and corporate infrastructure required to meet rapidly expanding adoption of additive manufacturing across our Industrial, Healthcare, and emerging biological markets, we believe we are well positioned to deliver sustained value creation to our customers and shareholders in 2023 and the years to follow."

Summary of Fourth Quarter Results

Revenue for the fourth quarter of 2022 decreased 12.0% to $132,732 compared to the same period last year, and non-GAAP revenue on a constant currency basis decreased 7.6%. The decline of non-GAAP revenue on a constant currency basis primarily reflects lower sales to certain dental market customers due to macroeconomic factors that are negatively impacting the demand for elective dental procedures, partially offset by continued solid product and service demand across other areas of the business.

Industrial Solutions revenue decreased 5.7% to $72,038 compared to the same period last year, however non-GAAP revenue on a constant currency basis increased 1.1% year over year. Healthcare Solutions revenue decreased 18.5% to $60,694 and non-GAAP revenue on a constant currency basis decreased 16.6% year over year.

Gross profit margin in the fourth quarter of 2022 was 41.2% compared to 43.9% in the same period last year. Non-GAAP gross profit margin was 40.9% compared to 44.1% in the same period last year. Gross profit margin decreased primarily due to input cost inflation and unfavorable product mix.

Operating expenses increased 18.0% to $82,674 in the fourth quarter of 2022 compared to the same period a year ago. On a non-GAAP basis, operating expenses were $64,144, an 18.2% increase from the same period a year ago. The increase in non-GAAP operating expenses primarily reflects spending in targeted areas to support future growth, including expenses from acquired businesses, research and development, and investments in corporate infrastructure.

Summary of Full-Year 2022 Results

Revenue for 2022 of $538,031 decreased 12.6% compared to the prior year. Non-GAAP revenue adjusted for divestitures and on a constant currency basis increased 3.3%. The increase in non-GAAP revenue reflects solid demand in both the Industrial and Healthcare Solutions segments despite macroeconomic challenges, offset by lower sales to certain dental market customers.

Industrial Solutions revenue decreased 10.5% to $277,043 compared to the prior year, and non-GAAP revenue adjusted for divestitures and on a constant currency basis increased 9.7%. Healthcare Solutions revenue decreased 14.8% to $260,988, and non-GAAP revenue adjusted for divestitures and on a constant currency basis decreased 2.9%.

Gross profit margin for the full year 2022 was 39.8% compared to 42.8% in the prior year. Non-GAAP gross profit margin was 39.8% for the full year 2022 compared to 42.5% in the prior

year. Gross profit margin decreased primarily due to input cost inflation and unfavorable product mix.

Operating expenses for the full year 2022 increased 11.6% to $331,252 compared to the prior year. The higher operating expenses reflect spending in targeted areas to support future growth, including expenses from acquired businesses, research and development, and investments in corporate infrastructure, as well as a $19,888 increase in legal and other settlement costs, partially offset by the absence of expenses from divested businesses. Non-GAAP operating expenses were $241,124 in 2022, a 22.1% increase from the prior year. The higher non-GAAP operating expenses primarily reflect spending to support future growth.

2023 Outlook

The company is providing full-year 2023 financial guidance as follows:

Revenue: $545 - $575 million

Non-GAAP Gross Profit Margin: 40% - 42%

Adjusted EBITDA: Break even or better

Free Cash Flow: Break even or better

For purposes of the above guidance, Free Cash Flow is defined as Adjusted EBITDA less changes in working capital less capital expenditures.

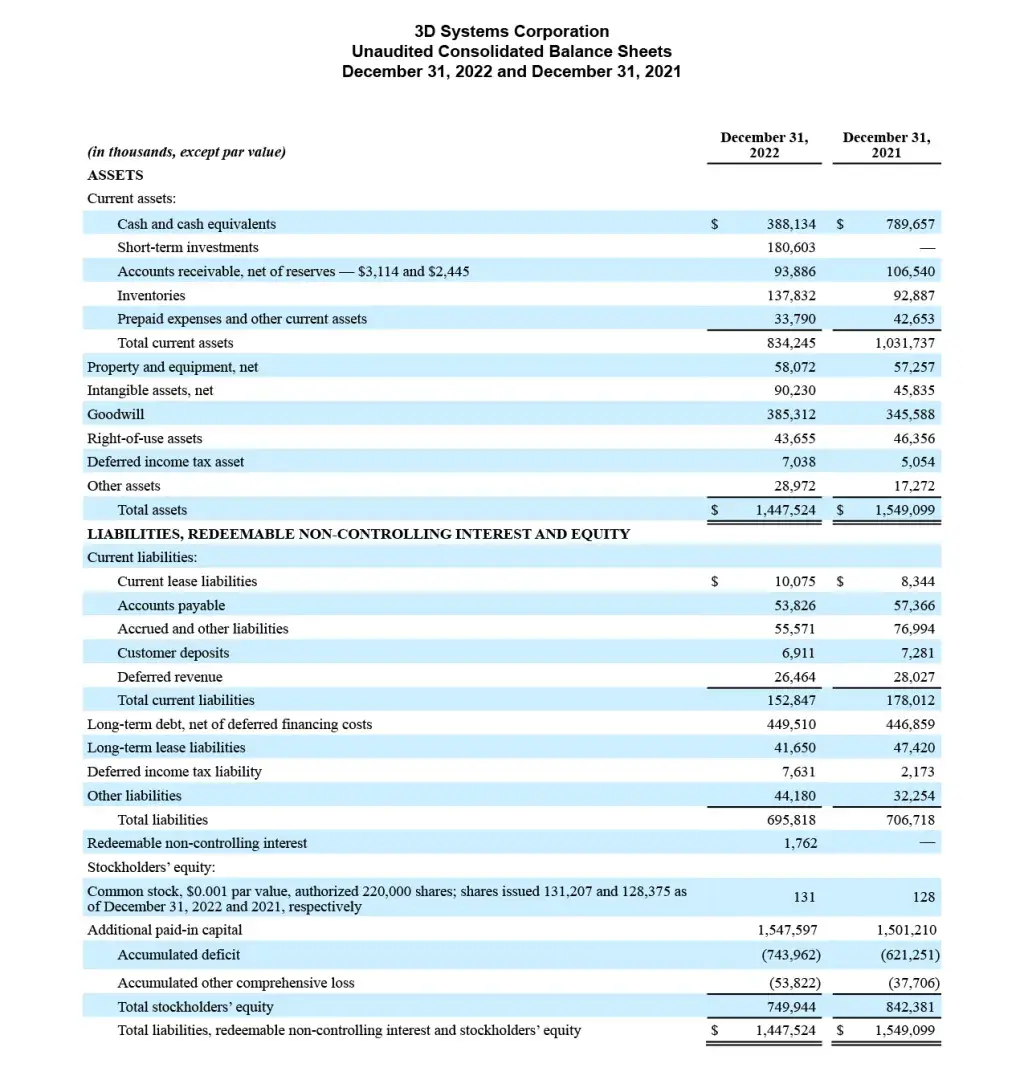

Financial Liquidity

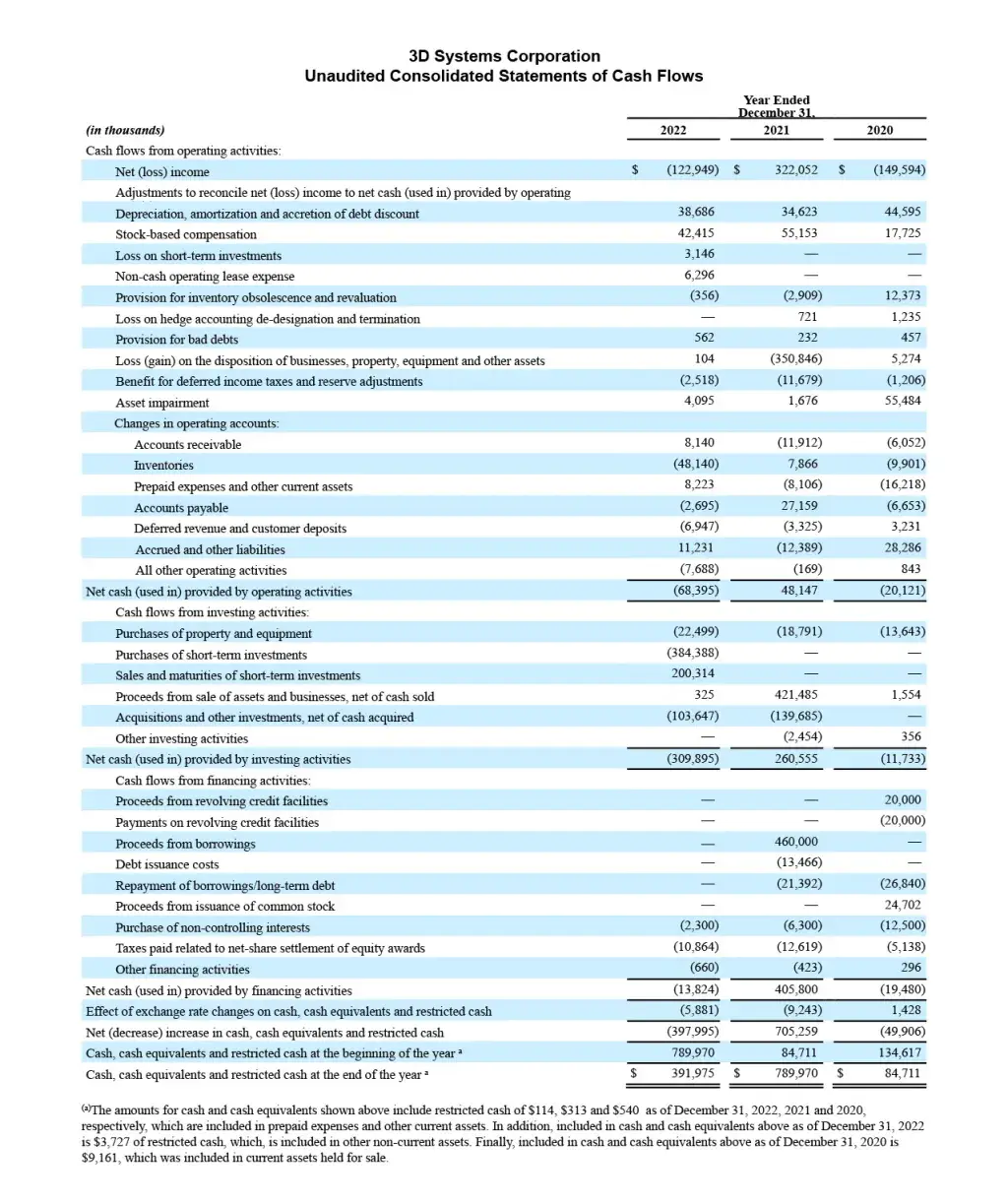

At December 31, 2022, the company had cash and cash equivalents and short-term investments of $568,737, a decrease of $220,920 since December 31, 2021. The decrease resulted primarily from cash paid for acquisitions and other investments of $103,647, cash used in operations of $68,395, capital expenditures of $22,499, and taxes paid related to net share settlement of equity awards $10,864. At December 31, 2022, the company had total debt net of deferred financing costs of $449,510.

Subsequent Events

Yesterday, the company resolved its ongoing export controls investigations with the U.S. Department of State, the U.S. Department of Commerce, and the U.S. Department of Justice. The company entered into individual settlement agreements which resulted in civil monetary penalties as well as certain remedial compliance measures to be completed as part of a three year consent agreement.

Q4 and FY 2022 Conference Call and Webcast

3D Systems will delay the filing of its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and file a Form 12b-25, Notification of Late Filing, with the Securities and Exchange Commission, which extends the deadline to file the Form 10-K. The delay in filing is primarily due to additional time required by the Company to complete its financial reporting close procedures. As a result, the Company's independent registered public accounting firm has not yet completed its audits of the Company's financial statements as of December 31, 2022. It has no impact on the company's operations or on its ability to discuss its 2022 results and 2023 outlook.

The company will host a conference call and simultaneous webcast to discuss these results on March 1, 2023, which may be accessed as follows:

Date: Wednesday, March 1, 2023

Time: 8:30 a.m. Eastern Time

Listen via webcast: www.3dsystems.com/investor

Participate via telephone: 201-689-8345

A replay of the webcast will be available approximately two hours after the live presentation at www.3dsystems.com/investor.

Forward-Looking Statements

Certain statements made in this release that are not statements of historical or current facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. In many cases, forward looking statements can be identified by terms such as “believes,” “belief,” “expects,” “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative of these terms or other comparable terminology. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations and may include comments as to the company’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors described under the headings “Forward-Looking Statements” and “Risk Factors” in the company’s periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. Although management believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at which such performance or results will be achieved. The forward-looking statements included are made only as the date of the statement. 3D Systems undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf, whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law.

Presentation of Information in this Press Release

3D Systems reports its financial results in accordance with GAAP. Management also reviews and reports certain non-GAAP measures, including: non-GAAP revenue, non-GAAP Gross profit, non-GAAP Gross profit margin, non-GAAP Operating expenses, non-GAAP Operating (loss)/income, non-GAAP Interest and other income/(expense), net, non-GAAP Net income (loss), non-GAAP Basic and Diluted Income (Loss) per Share, adjusted EBITDA and adjusted EBITDA Margin. These non-GAAP measures exclude certain special items that management does not view as part of 3D Systems’ underlying results as they may be highly variable, may be unusual or infrequent, are difficult to predict and can distort underlying business trends and results. Management believes that the non-GAAP measures provide useful additional insight into underlying business trends and results and provide a more meaningful comparison of period-over-period results. Additionally, management uses the non-GAAP measures for planning, forecasting and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets. 3D Systems’ non-GAAP measures are not calculated in accordance with or as required by GAAP and may not be calculated the same as similarly titled measures used by other companies. These non-GAAP measures should thus be considered as supplemental in nature and not considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP.

To calculate the non-GAAP measures, 3D Systems excludes the impact of the following items:

- amortization of intangible assets, a non-cash expense, as 3D Systems’ intangible assets were primarily acquired in connection with business combinations;

- costs incurred in connection with acquisitions and divestitures, such as legal, consulting and advisory fees;

- stock-based compensation expenses, a non-cash expense;

- restructuring charges (cost optimization plans), impairment charges, including goodwill, divestiture gains or losses, and severance charges pertaining to senior level employees;

- certain compensation expense related to the 2021 Volumetric acquisition; and

- revenue from divestitures included in current and comparable periods necessary to calculate revenue growth excluding the impact of divestitures.

Amortization of intangibles, acquisition and divestiture related costs are excluded from non-GAAP measures as the timing and magnitude of business combination transactions are not predictable, can vary significantly from period to period and the purchase price allocated to amortizable intangible assets and the related amortization period are unique to each acquisition. Amortization of intangible assets will recur in future periods until such intangible assets have been fully amortized. While intangible assets contribute to the Company’s revenue generation, the amortization of intangible assets does not directly relate to the sale of the Company’s products or services. Additionally, intangible asset amortization expense typically fluctuates based on the size and timing of the Company’s acquisition activity. Accordingly, the Company believes excluding the amortization of intangible assets enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance and to analyze underlying business performance and trends. Although stock-based compensation is a key incentive offered to certain of our employees, we continue to evaluate our business performance excluding stock-based compensation; therefore, it is excluded from non-GAAP measures. Stock-based compensation expenses will recur in future periods. Restructuring charges (cost optimization plans), impairment charges, including goodwill, divestiture gains or losses, and severance charges pertaining to senior level employees, are excluded from non-GAAP measures as the frequency and magnitude of these activities may vary widely from period to period. Additionally, impairment charges, including goodwill, are non-cash. Furthermore, 3D Systems excludes contingent consideration recorded as compensation expense related to the 2021 Volumetric acquisition from non-GAAP measures as management evaluates financial performance excluding this expense, which is viewed by management as similar to acquisition consideration.

The matters discussed above are tax effected, as applicable, in calculating non-GAAP net income and basic and diluted earnings per share.

Adjusted EBITDA, defined as net income, plus income tax (provision)/benefit, interest and other income/(expense), net, stock-based compensation expense, amortization of intangibles, depreciation expense and other non-recurring and/or non-cash items all as described above, is used by management to evaluate performance and helps measure financial performance period-over-period.

A reconciliation of GAAP to non-GAAP financial measures is provided in the accompanying schedules.

3D Systems does not provide forward-looking guidance for certain measures on a GAAP basis. The company is unable to provide a quantitative reconciliation of forward-looking non-GAAP gross margins and non-GAAP operating expenses to the most directly comparable forward-looking GAAP measures without unreasonable effort because certain items, including legal, acquisition expenses, stock-compensation expense, intangible amortization expense, restructuring expenses, and goodwill impairment, are difficult to predict and estimate. These items are inherently uncertain and depend on various factors, many of which are beyond the company’s control, and as such, any associated estimate and its impact on GAAP performance could vary materially.

About 3D Systems

More than 30 years ago, 3D Systems brought the innovation of 3D printing to the manufacturing industry. Today, as the leading Additive Manufacturing solutions partner, we bring innovation, performance, and reliability to every interaction - empowering our customers to create products and business models never before possible. Thanks to our unique offering of hardware, software, materials and services, each application-specific solution is powered by the expertise of our application engineers who collaborate with customers to transform how they deliver their products and services. 3D Systems’ solutions address a variety of advanced applications in Healthcare and Industrial Solutions markets such as Medical and Dental, Aerospace & Defense, Automotive and Durable Goods. More information on the company is available at www.3dsystems.com

Tables Follow